With the Major components of the Nasdaq releasing their earnings towards the end of the month and with the street’s expectations being positive with reports coming out from Apple, Microsoft, and Amazon?

Will the gains from the heaviest of weighted components be short lived or change the direction of the Major indexes from the US?

The US indexes have had a turbulent time coming into the New year, with the major indexes seeing themselves in correction territory for the second time this year.

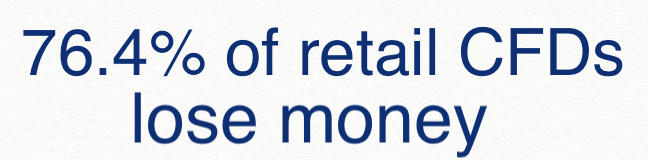

Trading these events at the present time brings on more variables than normal as the Fed rate decision has a bigger potential to move stock prices in comparison to moves normally seen after an earnings report.

Strong earnings from the big three could mean a spike in the US indices, but more than expected hawkish comments from the Fed could mean the gains are short lived and the downward trend continues.

Words of wisdom… Beats on earnings for the major weighted stocks doesn’t mean a change from last week’s downward trend. Mr Powell’s comments on Wed had what seemed like more of an impact than the actual earnings themselves during these present times for stocks.